Product Tax

Product tax change

Taxes are sums of money imposed by the government on individuals and companies to finance state expenses and provide public services. Taxation is an essential part of the tax system that serves to collect money from citizens and residents of the country.

Tax systems vary from country to country and include a variety of taxes, such as income tax, value-added tax, sales tax, customs duties, local taxes, and others. Tax rates, tax credits, and time limits vary in each country.

Taxes are intended to finance public services such as health, education, infrastructure, security and defense, promote the equitable distribution of wealth and stimulate economic growth. The government obtains funds from taxes and uses them to implement projects and programs for the benefit of society and meet its needs.

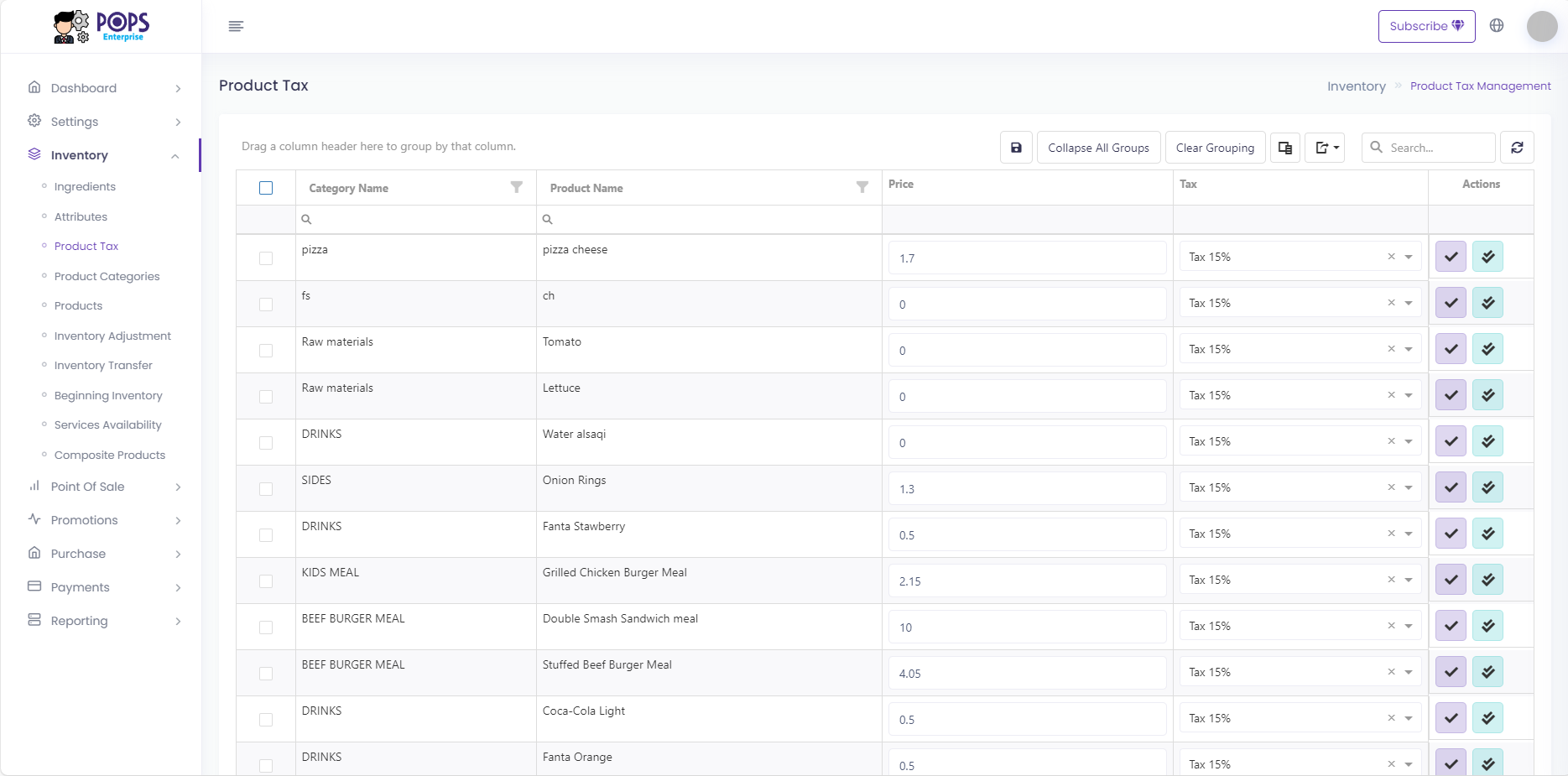

Due to taxation, Pops Enterprise provides you with a tool that makes it easier for you to set taxes on your own products, with the possibility of price changes.

Through the product tax tool, the tax rate can be changed for each product separately, and the tax on all products belonging to the same category can be changed by pressing the purple button.

The same tax can also be applied to all products by clicking on the blue button to easily apply the tax to all products available to you.

Prices for each product can also be changed separately in an easier and faster way from here.